On Thursday night, around 10, Hasan called me and said “Dada, I want to start investing. Please guide me.” After some formal conversation, I said, ‘ You know, I’m not an expert in this field. However, I can guide you through the basic norms of investment.” ” At this instance, my first guidance is: you must read the famous book ” The Intelligent Investor” by Benjamin Graham” I continued. ” Connect me after two days, let’s see what can I do for you? Brother” I said with my natural self-confidence. “Okay, Dada” he replied with some hope.

Hasan is a first-year physics student at Surendranath College, Sealdah, Kolkata. He called me on 26th August, 2023. Generally, students call me ‘Dada’ and I call them ‘Brother’. For me, ‘brother’ means ‘student’ both girls and boys. And I feel very much closer.

Initial Step Towards Money Literacy

Indeed financial literacy is a critical skill for students. Yet, many schools and colleges, especially in a country like India, don’t cover it in depth. However, understanding how to manage money, budget, and invest wisely can set students up for lifelong success. I know. But, the question is “How can I guide visionary students, like Hasan, to get personalized financial lessons. Of course, that suits their unique needs and learning pace? I’m totally confused about ‘What shall be our next step towards the journey of ensuring financial freedom(Hasan’s dream). But, I’m always optimistic. There is a will, there is a way.

Then, I start exploring the AI chatbot OpenAI’s ChatGPT. Obviously, I have some basic knowledge in the field of investment and AI. It is an excellent tool if you provide effective inputs or prompts to the chat bar. So, it’s a journey of crafting prompts, specially tailored for financial literacy lessons for high school or college students.

Therefore, this article will show you how to use ChatGPT to build money management lessons and provide prompts to get you started. The prompts include the basic budget, credit and loans, and investing basic and student loans.

Before jumping to the main topic, let’s understand financial literacy.

Why Personalized Financial Literacy Matters

Every student has different financial backgrounds, goals, and interests. A one-size-fits-all approach to financial education might not address everyone’s needs. For example, a student interested in entrepreneurship will have different questions than someone planning to work in a traditional career. Of course, personalized financial literacy lessons can bridge this gap, helping students focus on what’s most relevant to them. Ultimately, they can learn at their own pace and revisit topics as needed.

Let’s dive in!

How ChatGPT Can Help

Luckily, we live in the age of AI. ChatGPT is a versatile AI tool that can generate text based on the prompts you provide. When it comes to financial literacy, ChatGPT can create customized lessons, examples, and exercises that fit a student’s unique situation. So, by using specific prompts, you can guide ChatGPT to deliver content that is engaging and educational.

Next, move forward!

Getting Started with ChatGPT Prompts

To create effective financial literacy lessons with ChatGPT, you need to start with well-crafted prompts. However, these prompts will direct the AI to produce the content you need. Below are some example prompts for high school students. That will help you to create personalized financial lessons.

1. Basic Budgeting Skills

Budgeting is a fundamental skill in financial literacy. Use this prompt to help students learn how to create a budget:

Prompt: “Explain the steps to create a simple monthly budget for a student with a part-time job. Include tips for saving and managing expenses.”

ChatGPT can then generate a lesson that outlines the key steps in budgeting. It might suggest tracking income, listing expenses, and setting aside savings. By personalizing the prompt with details like “part-time job,” the lesson becomes more relevant to the student.

2. Understanding Credit and Loans

Credit is a concept that many students struggle with. This prompt helps break it down:

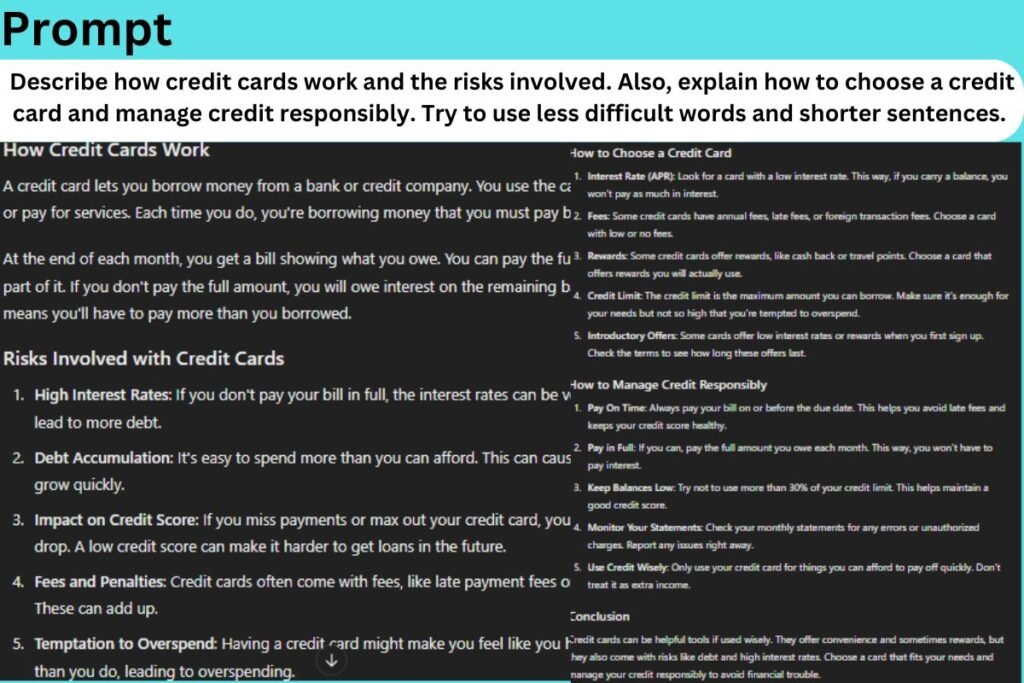

Prompt: “Describe how credit cards work and the risks involved. Also, explain how to choose a credit card and manage credit responsibly.”

This prompt guides ChatGPT to cover the basics of credit, including interest rates, credit scores, and the importance of timely payments. The lesson can also include scenarios to help students understand the impact of poor credit management.

3. Investing Basics

Investing is another crucial area of financial literacy. However, it can be complex. Use this prompt, for example, to simplify investing for students:

Prompt: “Introduce the basics of investing for a beginner. Explain different types of investments, like stocks, bonds, and mutual funds, and how to get started.”

ChatGPT can generate content that breaks down each type of investment, highlighting the risks and potential returns. Hence, this lesson can also provide simple steps for students who want to start investing, such as opening a brokerage account.

4. Saving for Long-Term Goals

Long-term financial goals, like buying a house or saving for retirement, require planning. This prompt can help students understand how to save effectively:

Prompt: “Create a lesson on how to save for a long-term goal, like buying a car or a house. Include tips on setting a savings target and choosing the right savings account.”

With this prompt, ChatGPT can produce a step-by-step guide that helps students set realistic savings goals. It might also suggest different types of savings accounts, such as high-yield savings accounts, to maximize their savings.

5. Dealing with Student Loans

Many students will face the challenge of paying off student loans. This prompt can help them prepare:

Prompt: “Explain how student loans work, including the differences between federal and private loans. Provide strategies for paying off student loans quickly.”

The lesson generated by ChatGPT can cover key topics like interest rates, loan repayment plans, and the benefits of paying off loans early. It can also include advice on managing debt and avoiding common pitfalls.

Customizing Lessons for Different Learning Styles

Not all students learn the same way. Some prefer detailed explanations, while others like hands-on exercises. ChatGPT can accommodate these differences by adjusting the style of the lessons. Here’s how you can customize the learning experience:

- For Visual Learners:

Prompt: “Create a visual explanation of how compound interest works, including a simple graph or chart.” - For Hands-On Learners:

Prompt: “Generate a budgeting exercise where students can track their fictional monthly income and expenses, then analyze the results.” - For Auditory Learners:

Prompt: “Write a dialogue between two friends discussing the pros and cons of investing in stocks versus bonds.”

Making the Most of ChatGPT-Generated Lessons

To get the best results, be as specific as possible with your prompts. Mention the student’s age, interests, or financial goals. The more details you provide, the more tailored the lesson will be. Also, encourage students to ask follow-up questions. ChatGPT can refine its responses based on these questions, providing even more personalized guidance.

My Opinions

Now, I’m going to share my personal opinions. As per my research and experience, there are some fundamental principles of investment that everyone should obey.

Core Principles Of Investment

According to Benjamin Graham,

Firstly, A good investor is a realist who sells to optimists and buys from pessimists.

Secondly, The higher the price you pay to buy a stock, the lower your return will be.

Thirdly, Never overpay no matter how exciting an investment seems to be.

Lastly, How your investments behave is much less important than how you behave.

For me, these are the four golden norms of investment. But, as a young beginner, you must play a safer game. May follow the following protocol that I generally follow:

Disclaimer: Any form of investment is subject to market risk. I’m not an expert in this field.

Safe Investment Protocol

- Save or earn at least Rs 500 per month.

- Open a savings bank account.

- Consult with the bank manager and set up SIP.

- Set SIP of Rs 500 or more towards small-cap mutual funds.

- Remember, Rs 500 or more, should be the remaining amount left after deduction of the minimal savings account balance(varies between banks).

- Do SIP through the authorised bank you are associated with.

- Invest it for a minimum of 15 years or more.

- You could get at least a 15% compound interest return per year after 15 years.

- Search on Google with “SIP Calculator” to calculate SIP. More years you invest means more return. This is the magic of compound interest.

- Try to increase the SIP amount, if possible.

Benefits:

- Establish a good asset(not million dollars).

- Low depression of investment.

- Get a return of 2 times that of the inflation rate per year.

- A sense of good financial management.

- Achieve financial freedom without the worry of losing money.

Contraindications:

- Select a reputed mutual fund.

- Avoid doing SIP through Third Parties.

- Avoid seeing the path of money, it may seem to fluctuate like a bouncing ball. But, never panic this is normal.

- Avoid withdrawing money from the bank before 15 years.

- See your SIP money as a donation and be relaxed.

- Control your greed(if any) towards money.

But, investment is subject to market risk.

Conclusion: Empowering Students with Financial Knowledge

Financial literacy is a vital skill that can empower high school students to make informed decisions. Of course, it lasts throughout their lives.

So, by leveraging ChatGPT, you can build a strong foundation in money management, investing, and financial planning. Ultimately, you can guide ChatGPT in delivering helpful content with the help of the prompts provided in this article. The output will be both engaging and educational. They might be tailored to each student’s unique needs.

But, remember, these prompts are given for a quick start. Better to craft your own.

In conclusion, ChatGPT is not a MAGIC tool. But, it’s an excellent knowledge hub.

It’s my pleasure to share all the insights that I have learnt while guiding my students with you.

Good Luck! Brother.